do you pay taxes on a leased car in texas

In most states you only pay taxes on what your lease is worth. The lessor is responsible for the tax and it is paid when the vehicle is registered at the local county tax assessor-collectors office.

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

The terms of the lease will decide the responsible party for personal property taxes.

. A car lease acquisition cost is a fee charged by the lessor to set up the lease. Nissan Juke 10 Dig-t 114 Visia 5dr. Technically there are two separate transactions and Texas taxes it that way.

If the lease states that you are responsible for these taxes you will then receive a bill from the dealership. It is typically in the range of 495 to 995 depending on the car company. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20.

Dacia Sandero 10 TCe Bi-Fuel Essential 5dr. This is different from most other states in which no such tax is charged to the lessor or the tax is administered in a different way. Car youre buying 50000 Car youre trading 30000 Trade Difference 20000 Taxes 2000006251250.

Yes in Texas you must pay tax again when you buy your off-lease vehicle. A motor vehicle purchased in Texas to be leased is subject to motor vehicle sales tax. If the buyer is living in another state then the tax would need to be paid in that state not in Texas.

In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor vehicle sales and use tax. The lease contract is not subject to tax. Yup you pay the tax twice unfortunately or just once if you had tax credits for the initial lease.

VAT-registered companies can reclaim up to 100 of the tax on vehicle payments on a business lease and on any maintenance. Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then youd be responsible for sales tax of 625 on 10000 or 62500. In a couple states such as Texas lessees must pay sales tax on the full value of the leased car what you described as the original price versus just the tax on payments during the time of the.

The monthly rental payments will include this additional cost which will be spread across your contract. If you dont have a trade then youre simply paying taxes on selling price. In some states such as Georgia you pay a title ad valorem tax up front on the capitalized lease cost or lease price see Georgia Car Lease for recent changes.

Any rentals for less than thirty days are considered to be subject to a gross rental receipts tax at the rate of 10. In the state of Texas you pay 625 tax on Trade difference Example. If you fail to submit that and the driver.

This may be a one-time annual payment or it may. High-end luxury vehicles have higher acquisition fees than lower-priced cars. This page covers the most important aspects of Texas sales tax with respects to vehicle purchases.

Its sometimes called a bank fee lease inception fee or administrative charge. For vehicles that are being rented or leased see see taxation of leases and rentals. If the vehicle you are purchasing has Tax Credits from the manufacturer LM then your tax.

Some dealerships may charge a documentary fee of 125 dollars. Texas collects a 625 state sales tax rate on the purchase of all vehicles. There are some available advantages to leasing a vehicle in a business name please consult your tax.

The acquisition fee will range from a few hundred dollars to as much a 1000 for a higher-end luxury car. One thing you do need to make sure gets done though is a vehicle transfer notification. Acquisition Fee Bank Fee.

Technically BMWFS bought the car the first time and the tax was due from. Usually when you sign the lease the terms state what you are responsible for. Leased vehicles produce income for the leasing company and are in turn taxable to the leasing company.

In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it. In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. Does that mean you have to pay property tax on a leased vehicle.

There are a couple of other options to minimise this if you plan to own the vehicle longer term such as BMWs Owners Choice which is designed to act like a lease but with the same benefits of a loan. Texas laws require that the lessor the lease company pay sales tax on the full value of any vehicle they buy from a dealer and lease back to a lessee you and me. In Texas all property is considered taxable unless it is exempt by state or federal law.

All leased vehicles with a garaging address in Texas are subject to property taxes. Acquisition Fee Bank Fee The acquisition fee is charged by the leasing company for setting up your lease and acquiring the vehicle for you. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer.

Most states roll the sales tax into the monthly payment of the car lease though a few states require that all the sales tax for all your lease payments be paid upfront. Leased Vehicles for Personal Use.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Car Sales Tax In Texas Getjerry Com

Car Financing Are Taxes And Fees Included Autotrader

Texas Car Sales Tax Everything You Need To Know

Car Leasing Costs Taxes And Fees U S News

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Which U S States Charge Property Taxes For Cars Mansion Global

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

U Haul Rental Agreement Form 1 Moments That Basically Sum Up Your U Haul Rental Agreement Fo Rental Agreement Templates Lease Agreement Lease

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog

Writing Off Luxury Vehicles Like A Tax Professional

What S The Car Sales Tax In Each State Find The Best Car Price

Just Leased Lease Real Estate Search Property For Rent

The States With The Lowest Car Tax The Motley Fool

Are Car Repairs Tax Deductible H R Block

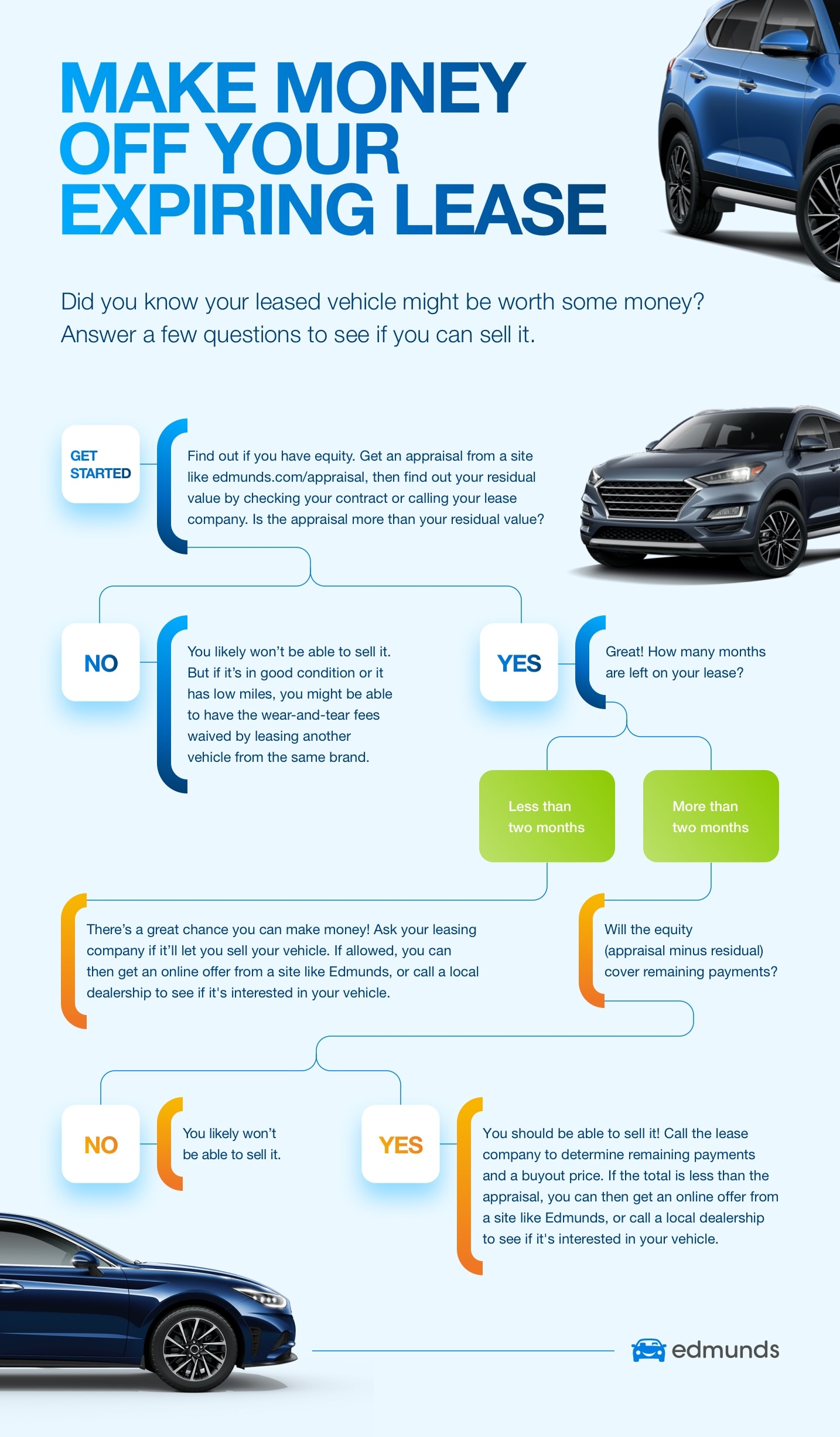

Consider Selling Your Car Before Your Lease Ends Edmunds

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels